To be in control of your finances and becoming a saver, debt repayment is key. Unless you can eliminate or better manage your debt, any plans for building your savings and reaching your financial goals will be delayed. With that in mind, here are five ways to reduce debt and protect your savings and goals.

Watch for interest rates

Better manage any potential debt by researching before you agree to a loan. The interest on a loan can be high, so you need to be vigilant. Before taking out a loan, for example, find out which bank not only providing the lowest interest rate. Always read the small fine print regarding repayments and be aware of the difference between simple and compound interest, which can have a huge impact on the amount to be repaid.

Assess your debts

If you are already in a situation where debt is a problem, you need to carefully check exactly what you owe. It may be unpleasant, but it helps to have a clear understanding of just how much debt you are dealing with, as well ensuring you have enough to pay the minimum monthly payment on each debt. It also gives you oversight to be able to prioritise your debts in terms of which ones need to be paid off first.

Paying off your debt – Finding the right method for you

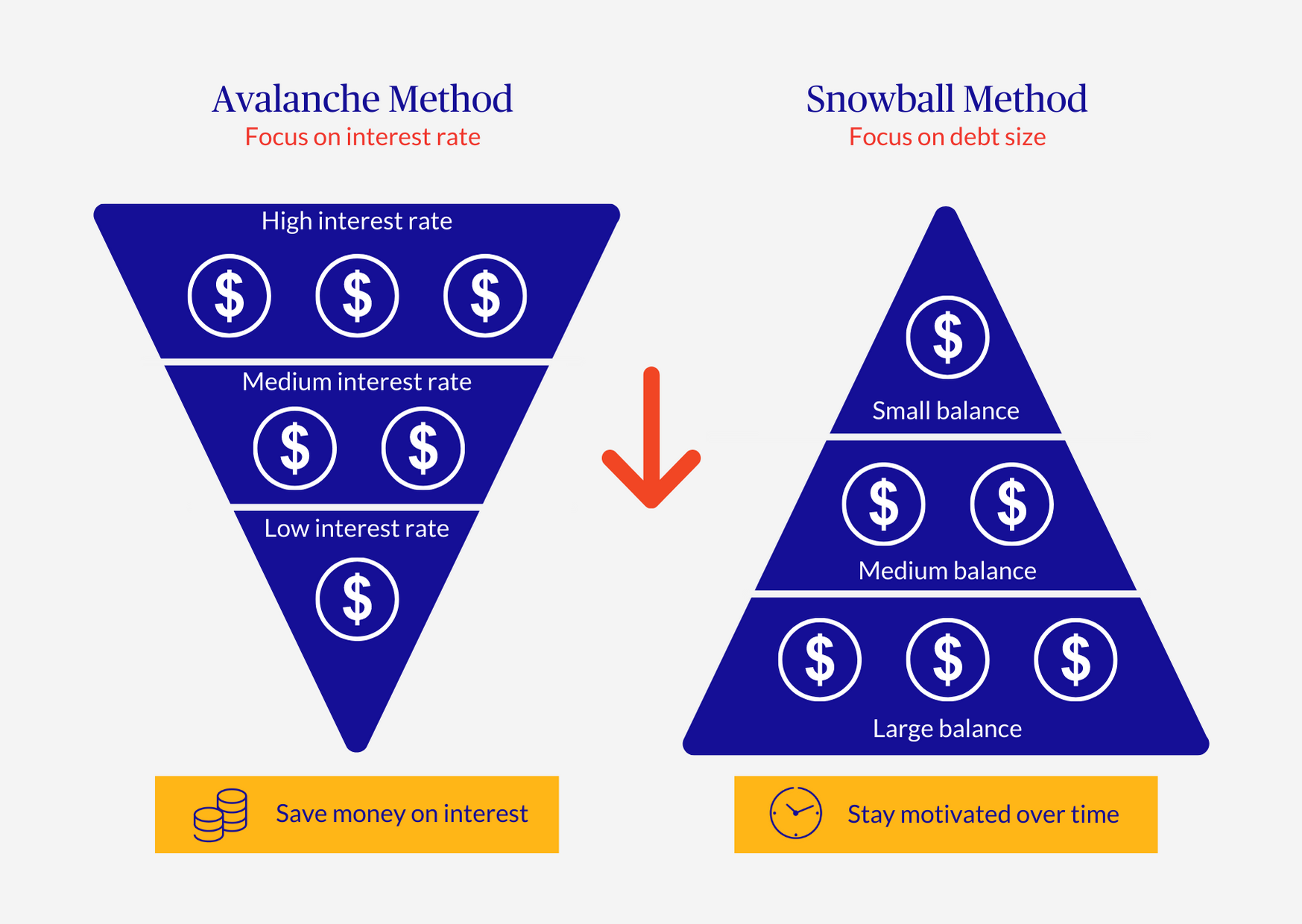

In terms of paying off debts, there are two main schools of thought – the Avalanche and the Snowball. Both methods require you to list out your debts and make minimum payments on all your debts except for one focus debt. The only difference is the order that you will pay them off:

The Avalanche Method – you pay off your debts with the highest interest rate first, regardless of balance.

The Snowball Method – you pay off your debts from the smallest balance first, regardless of the interest rate.

Mathematically, the Avalanche method is less costly in terms of interest rate and other fees. However, it may take a long period of time to pay off your first high interest debt and make it difficult to stay motivated.

The Snowball method forces you to focus on paying off one bill at a time and gives you motivation and confidence to get out of debt. However, the overall debt will not decrease if the loan with highest interest rate keeps increasing.

Which method is best for you depends on your situation and personality, but the most important part is to stick with your plan and manage your spending to ensure you never fall back in debt again.

Stay in control of your spending

The best way to avoid more debt is to put more effort into controlling your spending. This means sitting down and putting together a budget [link to article called “Beginners three step guide to financial planning”], including an effective way of budgeting income against spending. The simplest formula is to avoid spending more than you earn, cutting down on non-essentials and where possible try to use cash or debit cards rather than taking out loans.

Speak to our financial advisor

You can always speak with a Chubb Life Financial Advisor, who will guide you assess your protection needs and the right insurance for you and your family.

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks.